Findings From the Outlook: Unprecedented Capacity Investment Needed

Released in October, NYISO’s 2021–2040 System & Resource Outlook (the Outlook) examines infrastructure investment needs as the electric grid evolves over the next 20 years to meet requirements of state, federal, and local climate policies.

The report is intended to inform state policymakers, investors, and stakeholders regarding different pathways the state can take to achieve electrification of transportation and heating sectors of the economy, and the decarbonization of the power grid while maintaining reliability of the system. Electrification refers to the process of phasing out fossil fuels for heating and cooling, appliances, automobiles, and trucking.

The Outlook finds there are different potential approaches to resource and transmission investment that can achieve New York’s clean energy and climate change requirements. Each scenario analyzed looks at a variety of factors that will influence the level of investment in energy infrastructure.

Two scenarios examined in the Outlook make different assumptions about future peak demand and total electricity usage. The report found that consumer demand is forecasted to increase dramatically as a result of electrifying the state economy, and that the level of peak demand has the largest impact on capacity expansion requirements.

-

Scenario 1 - uses industry data and NYISO load forecasts, representing a future with high demand:

- 57,144 MW winter peak and 208,679 GWh energy demand in 2040

-

Scenario 2 - uses assumptions consistent with the Climate Action Council Integration Analysis. It represents a future with a moderate peak but a higher overall energy demand:

-

42,301 MW winter peak and 235,731 GWh energy demand in 2040.

-

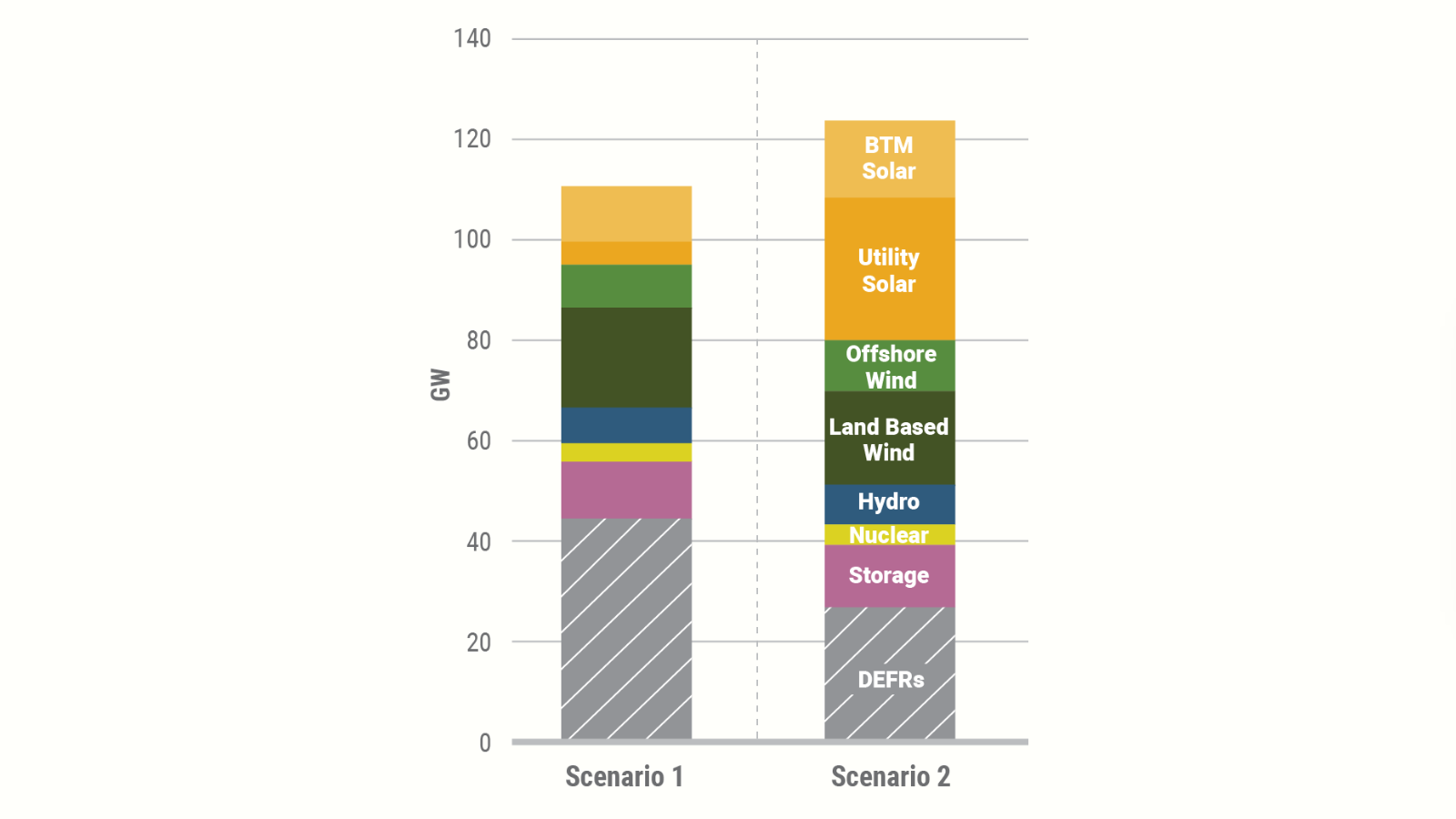

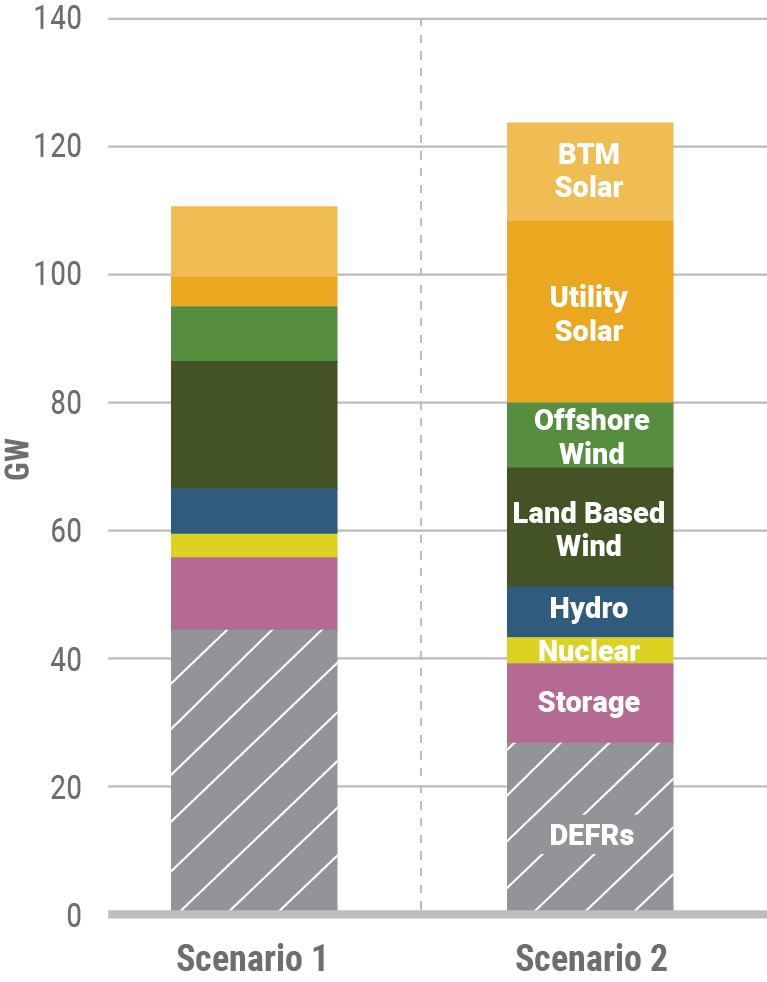

The mix of resources shifts under these scenarios, with Scenario 1 consisting of greater land-based wind development while Scenario 2 results in greater utility-scale solar development. Scenario 1 also notably integrates a greater degree of Dispatchable Emissions-Free Resources (DEFRs), which will be needed to help balance the intermittency of renewable energy production to continuously maintain reliability.

Both 2040 scenarios rely on having in place unprecedented levels of new supply. At least 95 GW of new or modified capacity will need to be added to the grid between now and 2040 to support existing resources.

- Under Scenario 1, with higher peak demand but lower overall energy consumption, 111 GW of total renewable and other zero-emissions resources would be required to reliably supply load.

- In Scenario 2, which assumes lower peak demand but greater overall energy consumption, 124 GW of such resources would be required.

In comparison, approximately 12.9 GW of new generating capacity was added to the bulk power system since wholesale electricity markets began more than 20 years ago. Over the past five years, generation deactivation has outpaced new additions: 2.6 GW of renewable and fossil-fueled generators came on-line while 4.8 GW of generation deactivated.

The Outlook key findings demonstrate the sheer scale of resources needed to satisfy system reliability and policy requirements within the next 20 years.

Learn More

For more about proposed paths for addressing this and other challenges, download the 2021-2040 System & Resource Outlook report.

View our datasheet on a summary of key takeaways of the Outlook report.