Understanding Real-Time Energy Prices

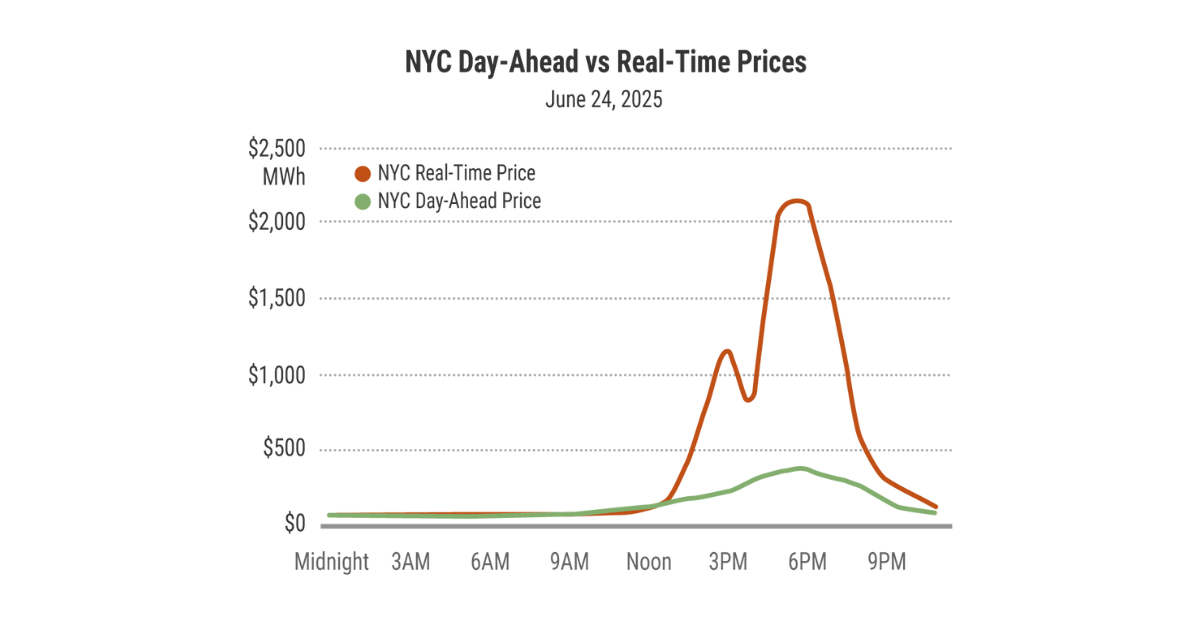

During periods of extreme weather – like the heatwave in late June – real-time energy prices can rise and fall dramatically. But these prices, shown on the NYISO Markets Real-Time Data Dashboard, don’t necessarily correlate with the number reflected on consumers’ bills.

In fact, real-time prices reflect a relatively small portion, roughly five percent, of daily electricity transactions. Most electricity sold through NYISO’s wholesale markets is purchased a day in advance of when it’s needed, through a competitive bidding process in the “day-ahead market.”

Overall, electricity prices in New York are on the rise, with both retail and wholesale components of consumers’ electric bills seeing an upward trend. But the drivers of these increases are largely associated with macroeconomic forces and rising costs resulting from public policies rather than real-time price fluctuations.

New York is retiring fossil fuel units faster than it is bringing new units online which is changing the supply-demand dynamics. Rising electricity demand, extreme weather, and gas pipeline constraints are also contributing to increased prices.

On the retail side, which is controlled by utility companies, the need to upgrade infrastructure to integrate clean energy resources and accommodate growing demand from electrification can lead to higher costs for consumers. Retail costs are also impacted by disruptions to the supply chain for equipment, goods and services, rising labor costs, and inflation.

Despite its relatively small number of financial transactions, the real-time market provides an important reliability function. The real-time energy market enables the NYISO and utility companies to respond to unforeseen events like generator or transmission outages and maintain adequate electricity supply and transmission to meet demand.

Every five minutes, the real-time market adjusts for changes in consumer demand and available supply from generators, addressing any discrepancies between the day-ahead schedule for generation and actual conditions. As with the day-ahead market, the real-time market selects suppliers based on expected system needs and competitive offers. The wholesale electric markets are designed to seek the lowest cost solution to balancing supply with consumer demand.

Utility companies also deploy hedging strategies to further reduce consumers’ exposure to wholesale price volatility. Utilities use a combination of fixed-price and hedged procurement contracts to provide some protection from that volatility and produce a more predictable and stable retail bill.